Solar City (SCTY $77.00) is a leading installer of residential solar systems. The company also builds larger units for commercial, military, and industrial applications. Solar City operates exclusively in the United States. Solar power has become more competitive with utility supplied electricity since the 2008 recession. The cost of solar panels plummeted due to excess supplies in China. Providing further impetus was a 30% federal tax credit contained in the 2009 federal stimulus package. The amount of electricity produced by solar systems is greatest in warm sunny regions. But the units have proven competitive in northern climates, as well, because those areas tend to endure much higher utility prices. Unit volume has been robust throughout the country.

( average output per 1 kilowatt system )

Solar City usually retains ownership of the residential systems it installs. Homeowners have the option to buy. But pricing is structured to drive business to the company's leasing model. No down payment is required. Homeowners simply agree to use the solar energy. If that runs out, then they can tap the utility grid. The purchase contract usually sets a price below the current utility rate. Escalators of 2%-3% a year customarily are built in. If the solar system produces more electricity than the homeowner needs, most states require the local utility to buy it at retail rates ("net metering"). Solar cells degrade 2%-3% per year. That reduction in output is offset by the escalating price in the lease agreement. Revenue is expected to remain consistent over the 20 year life of the deal. At that point customers have an option to buy the system. Or Solar City will remove it.

The industry is highly competitive. All the equipment that goes into a solar system is available from multiple sources. It has standard specifications. Installation techniques don't vary. Local building codes have to be satisfied. And marketing expense is steep, averaging $2,500 out of a total cost that averages $25,000. (If they were sold the retail price probably would be around $33,000.) Most competitors use the same pricing strategy. But they usually sell the systems to profitable financial entities that can utilize the 30% tax credit (plus whatever the states offer). The federal government also allows solar systems to be depreciated on an accelerated basis, over 6 years. Those deductions are attractive to financial buyers, as well. (The U.S. Treasury does not allow individuals to take depreciation deductions. That gives an economic advantage to corporate entities.)

Solar City follows a high risk, high return strategy instead. The company retains ownership of the systems, hoping it will earn a bonanza in 8-10 years. A series of complex off-balance sheet partnerships have been established under which Solar City borrows cash from financial investors to build out its network, and gives them the tax benefits. That reduces the amount that needs to be borrowed. Cash flow from the systems is directed towards repaying the loans. That pays down the debt. But it causes operating losses to expand as volume increases. So more cash needs to be raised to finance the next round of installations. In 8-10 years enough income will be freed up, as today's systems are paid off, to allow the company to start reporting profits. Income could surge in the early part of the next decade.

The largest risks are political. The 30% federal tax credit is scheduled to decline to 10% in 2017. Several states are considering a reduction in their subsidies, too. It's unclear if Congress will pass a new law to restore the 30% credit. Every percentage point removed would translate into a percentage point of lower profit margin, unless the price charged for electricity is increased. Solar City hopes to reduce operating costs enough to compensate for any reduction.

The net metering debate creates more political uncertainty. Utilities around the nation have begun to argue that solar and wind power are disrupting their grids' efficiency. They also say that other customers are being forced to pay more than they should, because the utility is required to repurchase power for wholesale purposes at retail prices. In most states the retail price is 3x the wholesale. If solar systems can't sell their surplus electricity at full price in future years, the reduction could impair the overall economics of the lease deal.

Solar City is hoping to develop lithium battery back-ups to alleviate the net metering threat. If the government subsidizes the batteries a move like that could prove beneficial, both to the solar companies and the grid operators. Adding a battery would make the entire system cost more, though. Whether there still would be enough room to discount from the utility's electricity rate is uncertain.

Low cost natural gas produced by the fracking revolution presents an economic challenge. Solar City established its business plan before natural gas was developed in abundant quantities. It expected electricity rates to keep increasing the way they had been. The advent of low cost natural gas has put a ceiling on utility rates, though. If the escalators in the company's contracts drive its price above the utility's, a variety of unforeseen problems could arise.

Longer term, next generation solar technology could make the company's installed base obsolete. Sleeker, more efficient systems are likely to be introduced before the end of the decade. Existing customers might be willing to live with their older units. But they could become an albatross when it comes time to sell the house. Maintenance and upgrades could be an expensive proposition for Solar City down the line.

Solar power is likely to become a major component in the country's energy mix. Substantial growth is likely. Solar now accounts for 1% of the United States's energy supply. In ten years that figure might reach 5% or more. If everything breaks right Solar City could become a highly profitable industry leader in 8-10 years. Right now, though, the company is losing money on every sale. It is surrounded by risk. The stock's valuation is high, at 26x our estimate of 2014 revenue. Our advice is to stay on the sidelines.

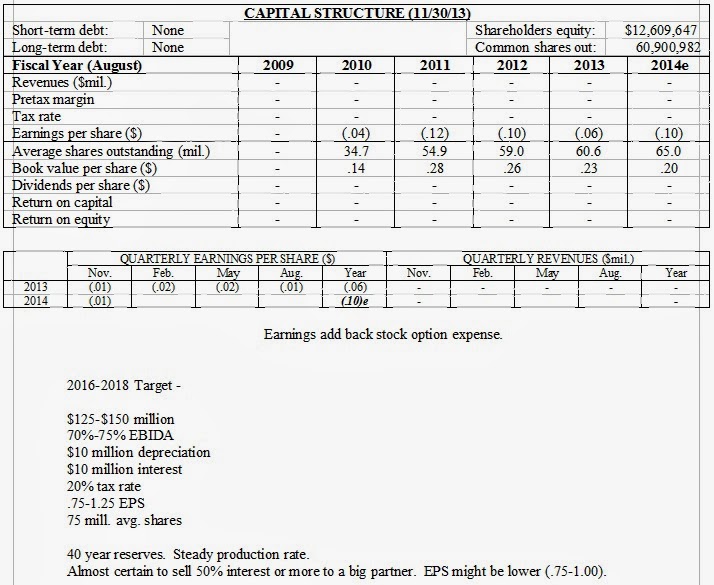

( Click on Table to Enlarge )