Scale up testing will begin early in 2014. Tasman recently raised additional capital to expand throughput and demonstrate its ability to produce high volume quantities at prices that are acceptable to the market. Alternative solutions exist. At this point those methods cost significantly more than rare earths. For Tasman to be successful it will have to keep costs below those other approaches. A handful of other non-Chinese reserves have been located during the last decade. Two are in northern Canada. A third lies in Greenland. Those reserves have not been developed to date due to substantially higher capital costs than Tasman faces. Since other options to rare earths exist, those sites may never be mined because of their remote and harsh locations. Recycling of rare earths takes place today but represents a small competitive factor. Approximately 1%-2% of the world's supply is generated in that fashion.

A large corporate partner is likely join the project if this year's scale up effort proves successful. Capital expenditures to develop the Swedish mine are expected to total $250 million. (The sites in Canada and Greenland are believed to require $1.2-$1.5 billion.) Tasman probably could borrow most of that and develop the project itself. Taking on a partner would reduce risk, however, and provide expertise and marketing outlets. Several interested parties already are lined up. Demand for the company's heavy rare earths is likely to be robust, particularly in Germany and Japan. Some financing may be provided by "off take" agreements where customers provide cash to develop the enterprise and receive rare earths as payment down the line.

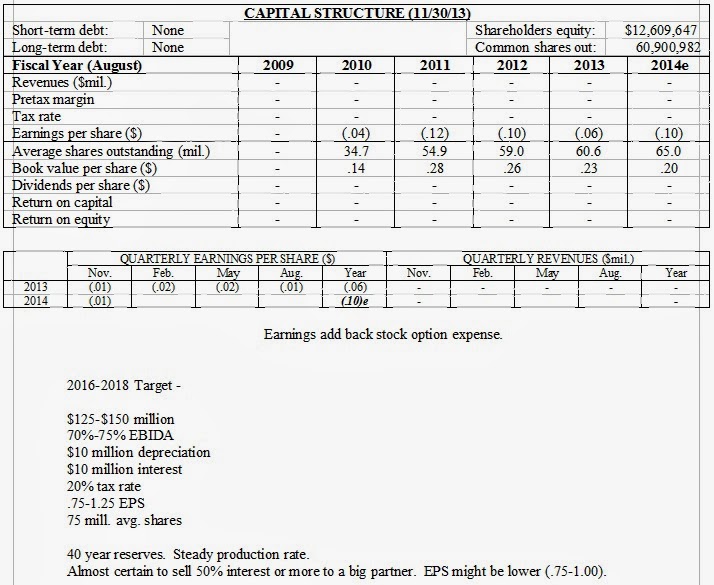

Sales could attain $125-$150 million a year once full production is achieved in 2016-2017. Tasman still is debating whether to employ an open pit or underground mining approach. Sales could go higher if the open pit method proves economical. If Tasman were to operate the entire project itself fully taxed income could reach a $.75-$1.25 a share run rate, depending on how many shares it had to sell and how much it could borrow instead. A 50-50 joint venture could yield income of $.50-$.75 a share. Long term sales contracts probably could be signed with multiple customers, ensuring steady recurring revenue. Rare earths are a proven commodity in the high tech industry. Even if alternative methods for creating magnetic fields are invented they probably would face a slow adoption curve as long as reasonably price rare earths were available from non-Chinese sources.

These shares entail a high degree of risk. Tasman may be unable to refine its heavy metals economically. It's possible the Chinese will develop new heavy rare earth reserves, raising competition. Lower cost alternative technologies could emerge, although those are difficult to visualize at this time. The main risk is internal. If Tasman can deliver the goods, exceptional investment returns are possible. The next key milestone will occur later this year when results from the current scale up effort become known.

( Click on Table to Enlarge )

No comments:

Post a Comment